Be Switched On to Priority Debts

1 in 4 people in the UK are behind on at least one household bill. Earlier this year, Citizens advice warned of a debt timebomb as more and more people are seeing that their income is not covering their essential costs. We help almost 40,000 people every month with debt issues and for many of those people, they are trying to manage multiple debts at once. If you find yourself in this situation, it is important to understand that some debts are more important than others.

What is a priority debt?

A priority debt is any type of debt which if not paid could give the person you owe money to, known as a creditor, the right to take your home and possessions, cut you off from essential supplies like gas or electricity or imprison you. These debts should be paid first. It is best to act quickly if you have one or multiple priority debts to give you the best chance of negotiating with your creditors.

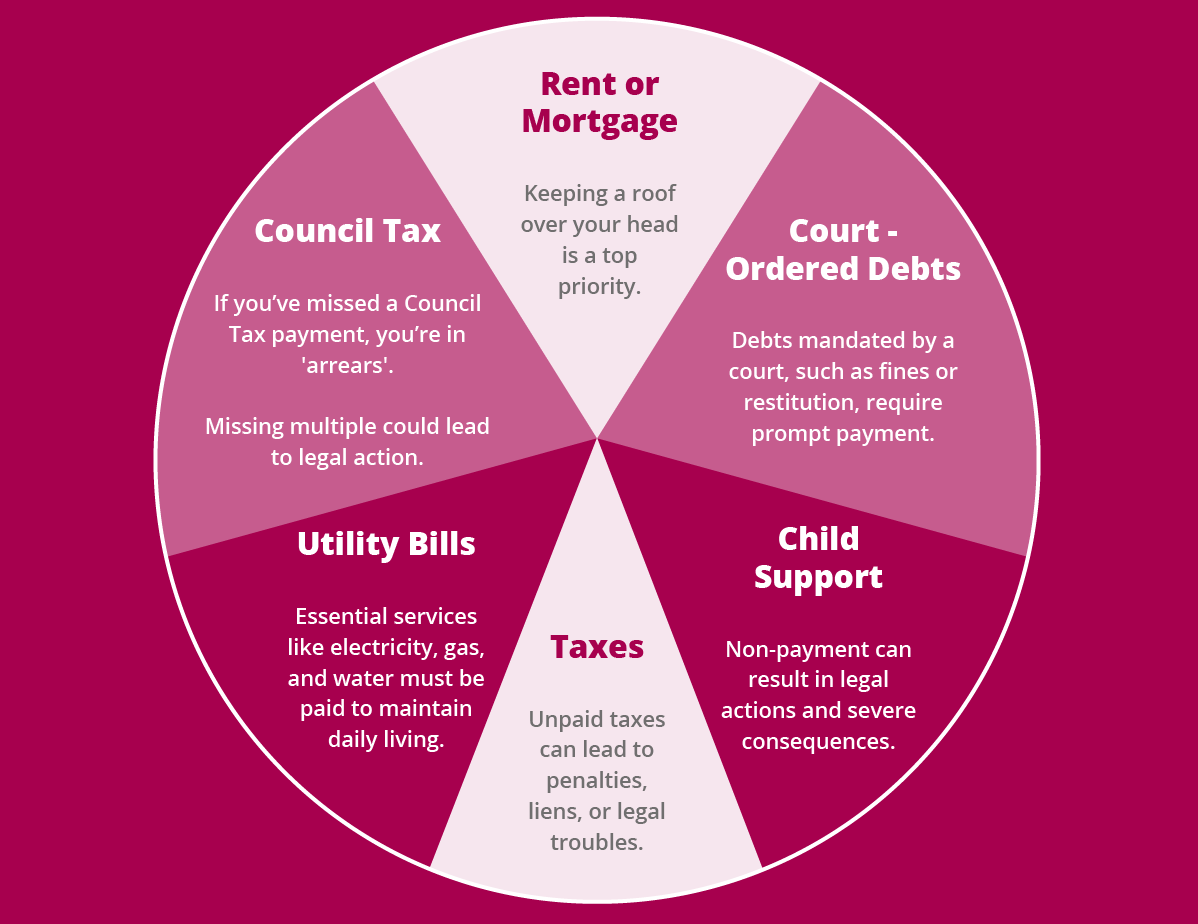

Types of Priority Debt

Find out more about some of the most common examples of priority debt by clicking on each section of the image.

Council Tax

This is a priority debt because if you do not pay it then your local council might take you to the magistrate’s court.

If you have the money but choose not to pay when the magistrate’s court tells you to, you could go to prison. You won’t go to prison if you can show you can’t pay.

Court-Ordered Debts

Court-ordered debts are when a court judges that you must pay a certain amount of money. This could include a fine for committing a crime such as driving offences or watching TV without a TV licence.

This is a priority debt because if you do not pay it then you may be sent to prison if you have the money but do not pay. You won’t go to prison if you can show you can’t pay.

Utility Bills

Utility bills are a priority debt because you may be cut off from your gas and/or electricity if you are in debt to your current to your current provider. If you have a prepayment meter and you don’t top it up, your energy supply may stop.

Debt to your water company is less of a priority than gas and electricity debt because the water company cannot cut off your access to water.

Child Support

This is a priority debt because the Child Maintenance Service can take the money from your wages or bank accounts if you don’t pay. They’ll warn you if they’re going to do this but they don’t have to go to court first.

If you have the money but choose not to pay, the magistrate’s court can take away your driving licence or passport for up to 2 years or send you to prison. The court won’t do this if you can show you can’t pay.

Rent or Mortgage

This is a priority debt because if you do not pay it then you may lose your home. If you are renting your property then your landlord may evict you and if you have a mortgage then your bank or building society may evict you.

To do this, a landlord or bank/ building society would first need to go to court to get a ‘possession order’ which gives you a date to leave your home by. If you do not leave by this date, then they can ask the court to set an eviction date.

Taxes

Unpaid income tax, national insurance or VAT then are priority debts because if you don’t pay, HM Revenue and Customs (HMRC) can take the money from your wages and/or use bailiffs to take your property.

HMRC will warn you if they’re going to do this but they don’t have to go to court first.

If you have the money but choose not to pay, HMRC can take you to court. If you don’t go to court when asked or don’t do what the court tells you to, you could be sent to prison.

You can’t be sent to prison or be evicted for not paying non-priority debts. However, if you don’t pay without giving an explanation, the people you owe money to may take you to court.

Many people mistakenly believe that credit card debts or loans are the most important so aim to pay these first. However, these are less likely to result in the loss of your home or imprisonment. However, your personal circumstances may mean that something which is a non-priority debt for most people, might be a priority for you. For example, if you owe money to family or friends and not paying them could result in serious personal problems.

How can I access help?

At Citizens Advice, we are here to support you if you find yourself with debt issues.

Find out more information about priority debts and how to manage them on the national Citizens Advice webpage.

Call our national debt helpline – it’s available 9am to 8pm Monday to Friday and 9.30am to 1pm Saturday : 0800 240 4420

Find out what the Citizens Advice Hull and East Riding debt team can help you with on our webpage.

If you would like to speak to one of our advisors then you can use our online self-referral form or come to a drop in session at one of our offices.