Money on Your Mind: 12 Tips for Christmas

Whether you celebrate Christmas or not, the festive season can have a negative impact on your mental health, and your bank balance. Sadly, the two can go hand in hand, and the current cost-of-living crisis is only making things worse.

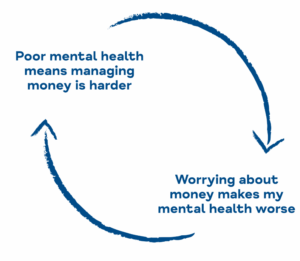

When you’re unwell, you might spend more money than you want to, or more than you can afford. If you’re struggling financially, then this can make your mental health worse.

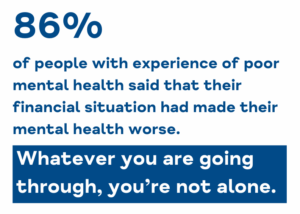

You might feel ashamed for needing support. You might feel stressed, afraid, and tired or worn down. But whatever you are going through, you’re not alone. There is support available to help with both your money and your mind.

Here are Hull and East Yorkshire Mind and Citizens Advice Hull and East Riding’s 12 tips for coping this Christmas:

- Plan ahead with a budget – Get started with your Christmas planning early. Make a realistic budget that covers gifts, events and self-care. Stick to the budget

the best you can. The Mental Health and Money Advice website has a free budget planner which might help.

the best you can. The Mental Health and Money Advice website has a free budget planner which might help. - Talk money – It can be hard to talk about money. However, research by the Money and Pensions department shows that being open and honest with others can help ease stress and allow you to make better financial decisions.

- Set maximum spends – Talking to people about money can help you manage expectations together. You may be able to agree on a maximum amount to spend on gifts with your friends and family. You may be able to agree to only make free or low-cost Christmas plans.

- Try to avoid comparisons – The Christmas you see in adverts and on social media often doesn’t reflect reality. Try to avoid feeling pressured into spending more than you can. It may help to take a break from social media if this is affecting you.

- Look for local low-cost events – Local organisations, such as charities and community centers, may have low cost or free events you can take part in. They may also be able to help with gifts and food.

- Don’t forget to pay existing bills – Christmas might feel like the top priority during December but remember it is most important to make sure you still pay your existing bills such as rent/mortgage, utility bills and food bills.

- Be careful with Buy Now Pay Later schemes– If you use these schemes to split payments over time, be aware that they are unregulated and do not offer the same protections as other forms of borrowing. You can incur late fees, they can affect your credit score and unpaid debts may be passed on to debt collection agencies.

- Have a plan to repay debts – If you are borrowing this festive season, think ahead to January and whether you will be able to repay what you owe on time. Include this in your budgeting. Make sure you’re claiming any extra money or support you’re entitled to, as this can help in the long run.

- Shop safely – If a deal looks too good to be true, then it probably is. To avoid disappointment and financial issues, be wary of scams especially whilst online shopping. Find more tips on this in our November blog.

- Start saving for next Christmas –Think about what worked this year and what you might do differently. If possible, put a little money aside each month to help next December.

- Be kind to yourself – Money worries can have a big impact on our mental health. They might make us feel concerned, embarrassed, or angry. And they can affect our self-esteem too. Try not to blame yourself for your situation or how you’re feeling about it. It’s important to remember that everyone has the right to feel well.

- Access support – Along with many other local and national organisations, Hull and East Yorkshire Mind and Citizens Advice can offer you support. If you have a money, housing, consumer, family or debt issue then use our self-referral form or national advice line: 0800 144 8848. For one to one or group support to help you with your mental health, call Hull and East Yorkshire Mind on 01482 240133 or complete the online referral form. The Mental Health Advice and Support Line is also available 24/7 over the festive period. You can call them on freephone 0800 138 0990.